As 2026 begins, the three major foreign trade markets—the United States, Canada, and Europe—are experiencing a wave of policy changes. News of canceled export tax rebates, tariff reductions, and escalating cross-border tariff disputes has been rolling in.

Let's take a look at what these new policies entail.

U.S. Market: Export Tax Rebates Adjusted for Multiple Products

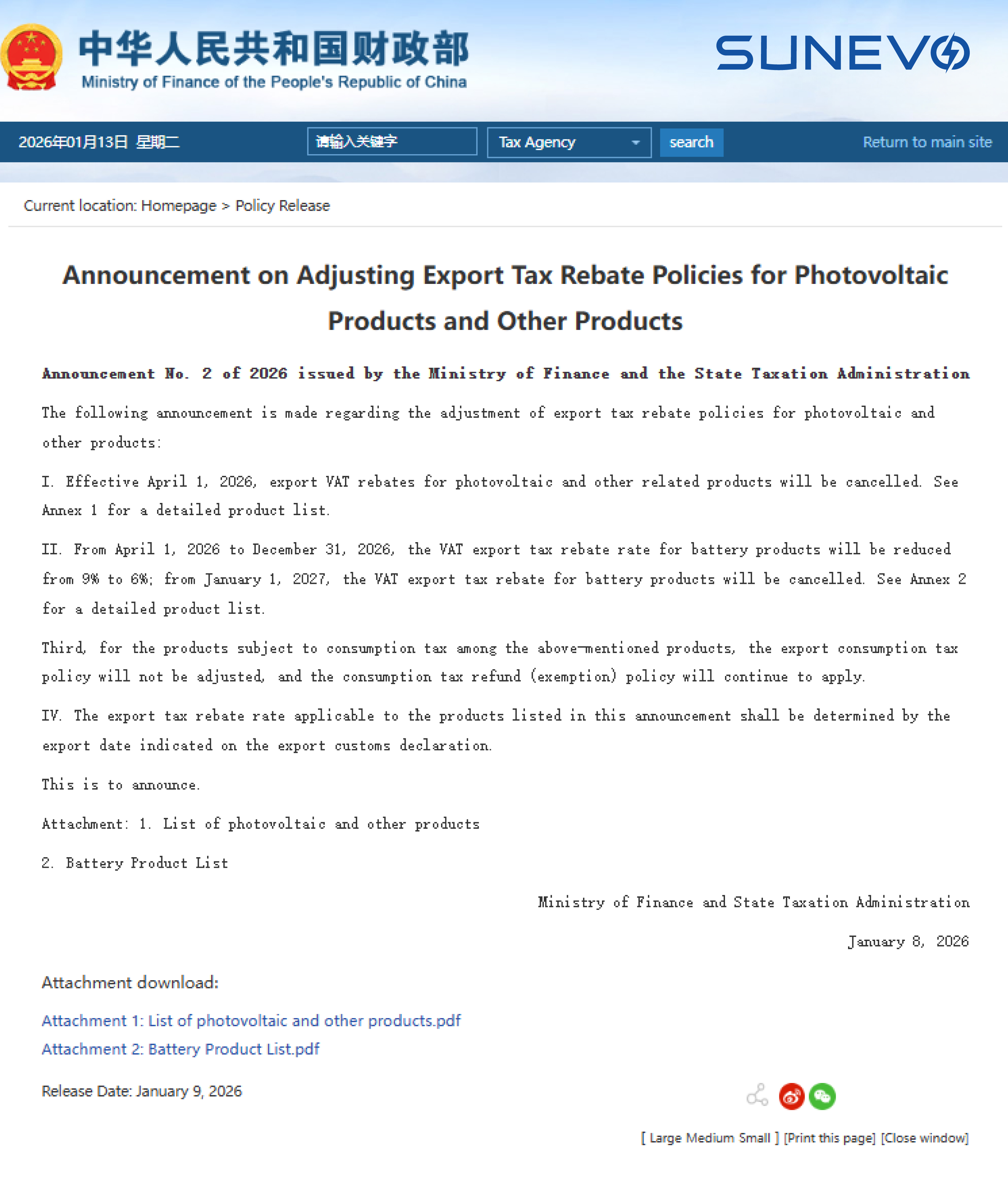

The Ministry of Finance and State Taxation Administration recently announced that starting April 1, 2026, VAT export tax rebates will be eliminated for products including photovoltaic and ceramic goods.

Battery products will have a transition period: from April 1 to December 31, the export tax rebate rate will decrease from 9% to 6%. Starting January 1, 2027, rebates will be fully eliminated.

These adjustments may directly increase export costs for relevant products and are expected to trigger concentrated shipments to the U.S. market.

For photovoltaic and ceramic products with existing orders, we recommend expediting logistics arrangements to avoid higher export costs after the policy takes effect on April 1. Battery exporters should seize the window before March 31 to arrange shipments and continue benefiting from the 9% export tax rebate rate.

Canada Line: Electric Vehicle Tariff Reduction Benefits

On January 16, Canadian Prime Minister Justin Trudeau, during his visit to China, announced reduced import tariffs on certain Chinese electric vehicles. This adjustment allows up to 49,000 Chinese EVs to enter the Canadian market at a 6.1% Most-Favored-Nation (MFN) tariff rate.

This tariff relaxation presents new opportunities for Chinese EV exporters to Canada. Relevant sellers should proactively arrange logistics and transportation to fully leverage this policy advantage, accelerate market expansion in Canada, and secure greater market share.

Europe Route: Escalating US-EU Tariff Trade Friction

On January 17 local time, President Trump announced additional tariffs on eight European countries:

Effective February 1, 2026, all goods exported to the United States from Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland will be subject to a 10% tariff.

Effective June 1, the tariff rate will increase to 25% until European nations agree to the U.S. demand to “purchase Greenland.”

This move has drawn strong opposition from Europe, escalating the tariff standoff between the U.S. and Europe. On the 18th, the U.S. Treasury Secretary publicly endorsed the policy, stating Europe would ultimately accept U.S. control over Greenland. Multiple European nations jointly condemned the U.S. actions and vowed retaliation. The EU is evaluating countermeasures, planning to impose tariffs on $93 billion worth of U.S. goods exported to Europe, potentially effective after February 6, while also considering freezing relevant U.S. market access.

While policy adjustments may trigger short-term market volatility, they also present new strategic opportunities. Cross-border sellers are advised to closely monitor policy developments, promptly optimize shipping schedules and market positioning strategies, effectively mitigate cost risks, and seize policy window opportunities.